Tax planning for foreigner residents in Thailand

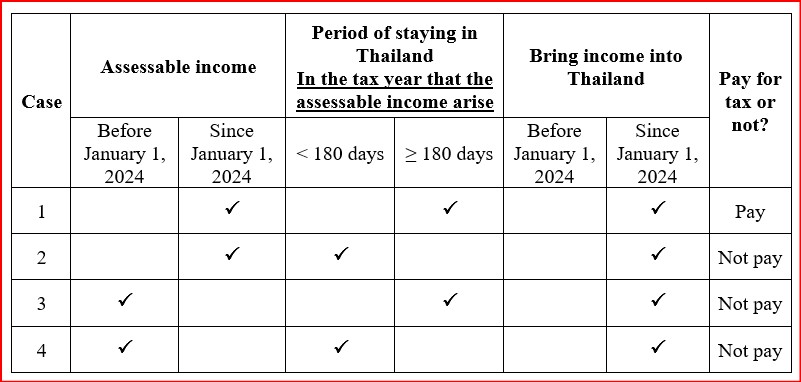

Foreigners are required to file tax return in Thailand if they fall under the following conditions:

- Such foreign individual has an assessable income from oversea income source since January 1, 2024 onwards, in the tax year that he/she stayed in Thailand more than 180 days or above and

- That person bring that assessable income into Thailand in that tax year or in subsequent tax years.

Remark: If such foreign individual falls under the above conditions, he/she has the responsibility to pay tax from such assessable income to combine and calculate for pay personal income tax in the same tax year that such assessable income was received into Thailand.

Panwa Group has services which includes consulting, planning, submission and we will serve you as representative person when requested by tax officer.

Service fees:

- Service fee for fill out and submit personal income tax for foreigner Baht 12,000 per year.

- Service fee for meeting, clarify and be a representative starting at Baht 3,000 and additional price per half day Baht 8,000.

- Service fee for tax planning, tax assessment and tax calculation is Baht 5,000 for first 2 hours.

Related Topics.

- Apply Tax Identification Number (TIN) – click here.

- Apply for Tax residence certificate – click here

- Filing Tax Return – Personal Income Tax. – click here.

Panwa Group has a foreign staff working full-time, supervisor and manager who is be able to communicate well in English. Therefore, you do not have to worry about the problem of communication.

QA – Filing Tax Return in Thailand for foreigner residents in Thailand

Q1 – What are the principles of the Revenue Department Order No. P.161 and P.162 ?Panwa: The Revenue Department orders No. P.161 and P.162 specifies the legal principles according to section 41, paragraph 2 that an individual has a responsibility to pay personal income tax from oversea income source under the following conditions:

Result: If the individual falls under the above conditions, such individual has responsibility to bring such assessable income to calculate and pay for personal income tax in the tax year that assessable income was brought in Thailand. Example: In the tax year 2024, Mr. A stays in Thailand totaling 200 days and he has assessable income from leasing of assets in oversea; for this case, it met the conditions stated above, which (1) Mr. A has assessable income from oversea in the tax year that he has stayed in Thailand for 180 days or above. If later in the tax year 2025, Mr. A transfers that assessable income to a bank account in Thailand, this case has been considered to meet the conditions. (2) This means that Mr. A brought that assessable income in that tax year or in subsequent tax years hence, Mr. A must bring such assessable income to combine and calculate for pay personal income tax for the tax year 2025.

|

Q2 – When is the effectivity of The Revenue Department Order No. P.161 and P.162 ?Panwa: The effectivity for the assessable income incurred and brought into Thailand is from January 1, 2024 onwards.

Example 1: In the tax years, 2023 and 2024, Mr. A, a resident in Thailand has the assessable income from the bank interest in oversea in tax year 2023 and the assessable income from condominium rental in oversea in the tax year 2024 and if for the tax year 2025, Mr. A bring both assessable income into Thailand, he does not have any responsibility to pay tax from the bank interest in oversea due to this is considered as the assessable income incurred before January 1, 2024. However, Mr. A still has the responsibility to bring that assessable income from condominium rental in oversea to combine and calculate and pay for the personal income tax year 2025 due to that is the assessable income incurred since January 1, 2024 onwards.

Example 2: In the tax year 2024, Mr. A, a resident in Thailand has the assessable income from the dividend in oversea then if in the tax year 2025, he brings such assessable income back into Thailand, he has responsibility to bring the assessable income of dividend in oversea to combine and calculate for pay the personal income tax for the year 2025 due to that is the assessable income since January 1, 2024.

|

Q3 – If the assessable income received before year 2024 was brought into Thailand in year 2024, will the foreigner be responsible to pay tax?Panwa: Do not need to pay any taxes due to that is the assessable income incurred before January 1, 2024. Example: In the tax year 2022, Mr. A stayed in Thailand totaling more than 180 days and he has provided consulting service in oversea and received the consulting service fee of Baht 50,000 then Mr. A transferred such consulting service amount back to Thailand in the tax year 2024, he does not have responsibility to bring the assessable income from the consulting service in oversea to combine and calculate to pay the personal income tax for the year 2024 due to that is the assessable income incurred before January 1, 2024. |

Q4 – Who are considered tax residents in Thailand?Panwa: Tax residents in Thailand are people who reside in Thailand for a total of 180 days or above between January 1 until December 31 of such year, whether staying in Thailand for a consecutive period or staying in Thailand for several periods combined which does not take into consideration the nationality or ethnicity of that person. Example:

|

Q5 – In case the foreigner has resided in Thailand for less than 180 days in a tax year however, has the assessable income from oversea in such tax year, does he/she need to pay for the personal income tax if he/she brings in such assessable income back into Thailand?Panwa: The foreigner is not required to pay personal income tax, whether he/she brings in such assessable income back into Thailand. Example: In the tax year 2024, Mr. A resides in Thailand for a total of 65 days only. Mr. A has assessable income from leasing of assets in oversea in such year and in the same year he transfers such income to the bank account in Thailand. Thus, Mr. A is not required to pay personal income tax for such leasing fee for year 2024 due to he is not a resident in Thailand when the assessable income occurred. |

Q6 – According to section 41, paragraph 2 of the Revenue Code, what types of assessable income must be taken into consideration to pay for personal income tax?Panwa: Under the regulation, section 40 (1) to (8) of the Revenue Code, the assessable income from overseas can be considered to pay for personal income tax. However, if such assessable income from overseas falls under the tax exemption of the Revenue Code, it is not required to bring such tax exempt assessable income to pay in Thailand. Examples are inheritance or money received from parents, descendants or spouse, income that does not exceed Baht 20 million throughout that tax year, etc. |

Q7 – How to calculate the capital gains tax?Panwa: The capital gains tax is calculated from the assessable income per transaction, which only the income that is over than the investment should be combined and calculated to pay taxes by deducting the selling price with the cost price from the date that the money was received. For cost recording, it follow the generally accepted accounting principles that is suitable for the activities and type of assets. |

Q8 – What does “bring in such assessable income to Thailand” means?Panwa: It pertains to any actions that bring the assessable income into Thailand, such as transferring assessable income through bank account, transferring assessable income via ONLINE system, or bring assessable income by cash when you come in Thailand, etc. Example: Ms. B is a resident in Thailand and she transferred the amount Baht 200,000 to the bank account in oversea and receive interest from such bank in amount of Baht 10,000. Later |

Q9 – In case client increase investment every single year and during that time has bring in some amount of assessable income to Thailand, how can they differentiate such certain amount that was brought in if it can be considered as principal or part of profit?Panwa: Bringing money into Thailand, a taxpayers have to evaluate themselves follow the facts appearing that the money that bring in is an assessable income or investment fund. |

Q10 – In case of transferring money to overseas and bringing such money back into Thailand, does it have to pay taxes? Or how?Panwa: Does not have to pay tax. In case transfer the investment fund to overseas and transfer such money back into Thailand, that is not considered as the assessable income. Example: Mr. A transferred Baht 200,000 to the overseas investment account. Later Mr. A closed such investment account and brought the amount of Baht 200,000 back into Thailand. Such amount is not considered as assessable income and Mr. A does not have any responsibility to pay tax from bringing such amount to Thailand. |

Q11 – If bring money and deposit in the bank in oversea and receive the interest from such deposit, then later bring the principal and interest back into Thailand, does he/she need to bring such principal and interest to combine and calculate for pay personal income tax?Panwa: For the principal, it does not need to pay tax however, he/she must pay tax for the interest which is the assessable income according to Section 40 (4) (K) of the Revenue Code that was brought into Thailand in the tax year that such interest was received and that person is a resident in Thailand for 180 days. Example: In the tax year 2024 that Mr. A resides in Thailand exceeding 180 days, Mr. A has brought money, in amount of Baht 5,000 in the tax year 2024. Later in the tax year 2025, Mr. A transferred all money back into Thailand, then Mr. A has responsibility to bring only the assessable income from interest from the bank in oversea which is the assessable income since January 1, 2024 to combine and calculate to pay personal income tax for year 2025. |

Q12 – Which exchange rate have to be used for calculate the assessable income?Panwa: The exchange rate on the date that the assessable income was brought into Thailand |

Q13 – For the case of taking money to buy stocks in oversea. At the end of the year, stock prices in oversea are increased without selling such shares. Does it need to pay taxes? Or how?Panwa: Does not have to pay tax, due to such shares have not yet been sold, which is a benefit received in excess of the principal. It is not considered having assessable income according to Section 40 (4) (Ch) of the Revenue Code. Example 1: In the tax year 2024, Mr. C resides in Thailand exceeding 180 days and he bring money to buy stocks A in oversea on March 15, 2024 for 100 shares and Baht 1,000 per share, totaling Baht 100,000. Then later, on December 31, 2024, the stock price are increased to Baht 1,100 per share. Therefore, Mr. C has an unrealized profit (UNREALIZE GAIN) increasing Baht 10,000 on December 31, 2024 which Mr. C has not yet been sold any of such shares thus, it is not considered as assessable income according to Section 40 (4) (Ch) of the Revenue Code. Example 2: Later in the tax year 2025, Mr. C resides in Thailand exceeding 180 days and he sells stocks A in oversea for 80 shares on June 1, 2025, in amount of Baht 1,200 thus, he has profit (UNREALIZE GAIN), in amount of Baht 16,000 on June 1, 2025 which is considered as assessable income from the profit received from selling the said stocks that is estimated to be income exceeding than principle according to Section 40 (4) (Ch) of the Revenue Code. However, for another 20 shares of stock A that Mr. C has not yet been sold, it is not considered as assessable income according to Section 40 (4) (Ch) of the Revenue Code. Example 3: Later in the tax year 2026, Mr. C brings the profit from selling of stock A, in amount of 80 shares on June 1, 2025 which is considered as assessable income according to Section 40 (4) (Ch) of the Revenue Code back into Thailand. He has the responsibility to bring such assessable income from selling of shares in oversea to combine and calculate to pay personal income tax for year 2026, due to it is assessable income incurred since January 1, 2024 |

Q14 – If a person resides and work or carry on the business in oversea for a long time and later requires to come back and reside in Thailand, then he/she brings the accumulated income from working or doing business in oversea back into Thailand, will such person have to pay tax on bringing those accumulated funds into Thailand?Panwa: Does not have to pay tax in the case of bringing accumulated income from working or doing business in oversea come into Thailand, due to such accumulated income came from the assessable income occurred in the tax year that the person resides in Thailand not exceeding 180 days. Example: Mrs. G is a Thai national and resides in China since 2007. However, in year 2024, she wishes to come back and reside in Thailand permanently and she also brought all accumulated income from doing business in China back into Thailand thus, Mrs. G does not have a responsibility to pay personal income tax from bringing such income into Thailand in 2024 due to such accumulated funds came from the assessable income incurred in the tax year that Mrs. G is not resident in Thailand. |

Q15 – If the assessable income brought into Thailand is the income that paid taxes in oversea already, if bring such income into Thailand, does it need to pay for tax again, is it double taxation? And can they bring the income tax that is paid in oversea to eliminate double taxation?Panwa: Does not have double taxation. Moreover, in the case of being a tax resident in Thailand (resides in Thailand 180 days), he/she can bring the tax paid in oversea, which it can be credited with the tax paid in Thailand in the tax year that the assessable income was brought into Thailand according to “Double Tax Agreement” that Thailand is a contracting party with that country. |

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th (Mr. Tana Sipa)

WhatsApp: +66 81 919 6225

LineApp ID: @panwa