Special Business Tax Registration

Any entity that operates the business of foreign currency exchange has responsibility to pay for special business tax and must be registered with the Revenue Department (Form P.T.01) after the entity has obtained the Money Exchange License within 30 days from the date of operation. In addition, the application forms must be submitted to the area Revenue Department follow the location of the entity.

Service fee for Special Business Tax Registration is Baht 10,000

Processing time

After we receive all required documents and director signs the documents, we can proceed for Special Business Tax Registration which we can finish within 1 working day and the Special Business Tax Certificate (P.T. 20) will be sent to the company’s address within 30-45 days after registration.

Required Documents:

- Special Business Tax form (P.T.01)

- Copy of company’s affidavit & objectives (updated within 6 months)

- Copy of company’s certificate

- Copy of Memorandum of Association (BOJ.2)

- Copy of BOJ.3

- Copy of Minutes of Statutory Meeting

- Copy of Article of Association (if any)

- Copy of shareholders’ list

- Signed copy of Thai ID card or Passport of the authorized director(s)

The evidence of company’s address which consist of:

- Copy of house registration of the company’s address

Remark: Copy of title deed or purchase agreement may be required to present to the tax officer if the house registration did not mention the name of the house owner. - The rental agreement issued under the company name

- The permission letter

- Location map of the company

- Photographs of the company which must show the company’s name, house number, exterior full building and interior building

- Signed copy of ID card and house registration of the house owner

Remark: In case the house owner is a juristic person must provide the copy of company’s affidavit & objectives (updated within 6 months) as signed by the director

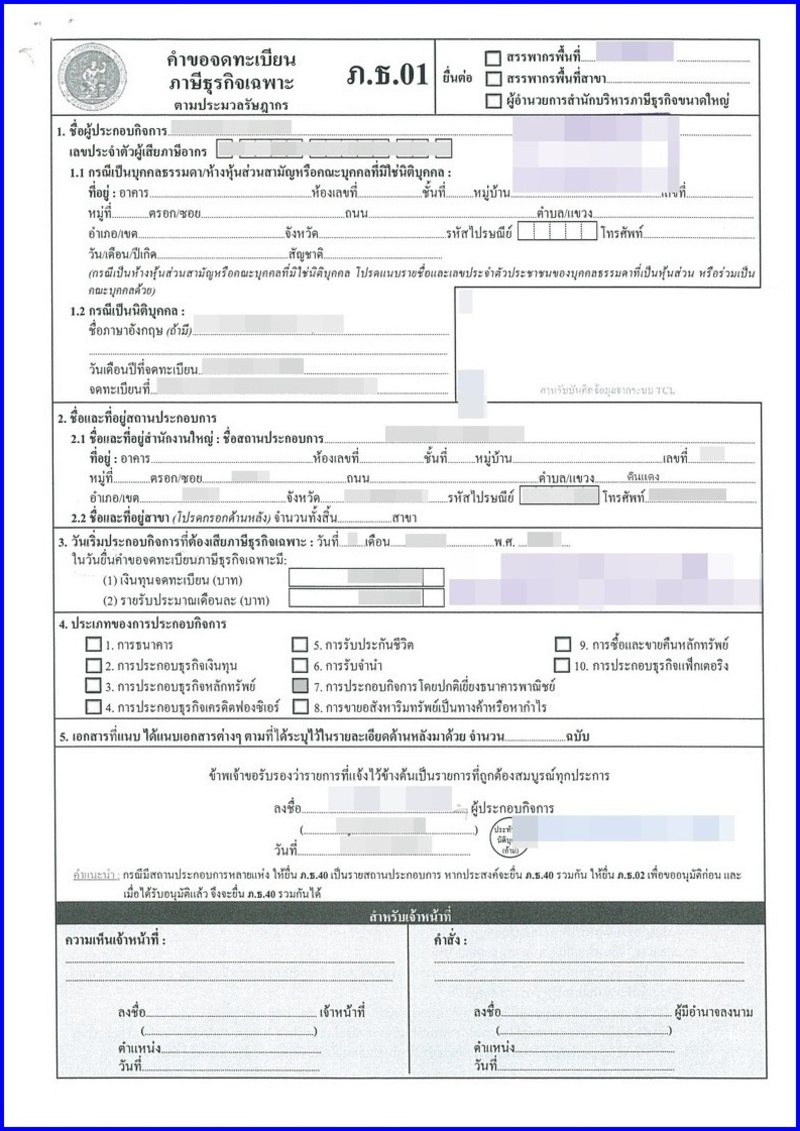

Sample of Special Business Tax Form

Related topic:

- Apply for Money Exchange License – Click here

Questions and Answers

Q1 – I set up a company to conduct the foreign currency exchange business and our company already received the money exchange license. Anyway, I have done the primary research that this kind of business is a proper business which the company must register for special business tax and I do not understand much the details of this matter. Hence, I would like to inquire the details from you for special business tax registration and what are the required documents?Panwa: Special Business Tax is the tax collected for some kinds of businesses as per the special law that is different from Value Added Tax (VAT) which the company that operates the business related to money exchange must fall under the conditions to register a special business tax. |

Q2 – If the company received the money exchange license from the Bank of Thailand, is it necessary for the company to register for special business tax immediately?Panwa: Please note that the special business tax must be registered with the area Revenue Department within 30 days after the operation date. If submit the complete documents already, the tax officer will approve and issue the P.T.01 form for temporary use while waiting for the Special Business Tax Certificate which it will be sent to the company’s address within 30-45 days after registration. If in case of the company is registered delay over than 30 days after obtain the money exchange license, the Revenue Department will collect the delay penalty of about Baht 3,000. |

Q3 – After the company received the money exchange license and registered for a special business tax already but still do not receive the Special Business Tax Certificate, for this case, can we operate the business directly and do we have any responsibility for those matters?Panwa: Yes, you can operate the business directly which the company has a responsibility to submit the report to Bank of Thailand every month and for the special business tax (P.T. 40), it must also be filed to the Revenue Department every 15th of the following month. |

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th

WhatsApp: +66 81 919 6225 (Mr. Tana Sipa)

LineApp ID: @panwa