Representative Office in Thailand

Panwa offers full service for representative office which are

- Registration – Set up a representative office

- Accounting – Tax for a representative office including monthly report, quarterly, yearly report

- Auditing service

- Registration for dissolution (closing) the representative office in Thailand

Registration – Setting up a representative office in Thailand

Service fee is 50,000 Baht

Timeline – 10 working days

Required Documents for setting up a representative office in Thailand

- Certificate of head office in abroad certified by Notary Public and translated into Thai version

- A letter of appointment of a representative certified by Notary Public and translated into Thai version

- Passport or Copy of ID card of a representative (Foreigners must sign the documents in Thailand)

- Power of attorney for Nara Accounting to act on the representative behalf towards government agencies (Nara Accounting arranges for this)

- The others information will be informed later which requires to keep at representative office although it is not submitting

Remark: Since the notice of the Ministerial Regulation No. 7 on the date of 26th May, B.E. 2560 (A.D.2017) about the scope of service business which is not required to register for alien to operate business results in good effects to operate representative office in Thailand as follows.

1.No need to ask permission to set up a representative office in Thailand becomes popular for many alien juristic persons and relaxes the various rules; however, the representative office still needs to gather the various evidences at the representative office because it may be randomly checked by the Ministry of Commerce later.

2.No need to pay the registration fee, the original fee (the old policy – registered) is up to the maximum level of hundred thousand, but in the present, it doesn’t need to pay any fee.

3.Currently the minimum capital to be brought into Thailand is 2 million Baht (the original capital – 3 million Baht).

4.Sending the evidence of transfer, in the present it is not required to send the evidence of transfer within 3 years, however, the representative should keep the transfer evidence of credit advice of bank which shows the transfer currency in Baht by keeping at the representative office due to it may be randomly checked by the Ministry of Commerce later.

5.No need to send the technology transfer plan and no need to present implementation project in Thailand.

*** With the reason of being flexible at the representative office in Thailand doesn’t need to register which makes the setting up process easier than before which takes an average time of not less than 8 months and pay the government fee follow the capital of head office.***

Things must know for operating representative office in Thailand

The scope of operating business as representative office can provide the service within its scope or limited 5 business activities in accordance with the regulations of the Office of the Prime Minister in Establishment of Work Permit and Visa Center (No.3) B.E. 2544 (A.D.2001) by the representative office can provide either one or 5 business activities depending on the purpose and nature of the representative office as follows.

1.Reporting business movements in Thailand to head office or its affiliated companies or its group of companies

2.Consultation on various aspects pertaining to the goods in head office or its affiliated companies or its distributing group or consumers

3.Procurement of supply sources of goods and services in Thailand for the head office or its affiliated companies or its group of companies

4.Inspection and control of the quality and volume of goods purchased by the head office or its affiliated companies or its group of companies or hired by the head office for production in Thailand

5.Dissemination of various information pertaining to new goods or services offered by the head office or its affiliated companies or its group of companies

The approved representative office must comply with certain terms and conditions, with details, as below:

- The representative must bring in the minimum capital of Baht 2 million to Thailand follow the scope of business as regarded by the law (decreased from original capital of 3 million Baht)

- All loans which are used to a licensee’s business operations can be made to an amount not exceeding seven times of the bring in capital to conduct the approved business

- Loan is defined as the total liabilities of the business regardless of any debt incurred by any form, excluding of ordinary business transactions such as trade payable, accrued expenses

- The representative who are in charge of the operations in Thailand, at least one such person must have residence in Thailand

- Residence is defined as a place to live in Thailand which can be contactable, such place could be office excluding of temporary accommodation such as hotel

- The representative must submit the evidences or documents related to the approved business when the authority has meet letter or any inquiries

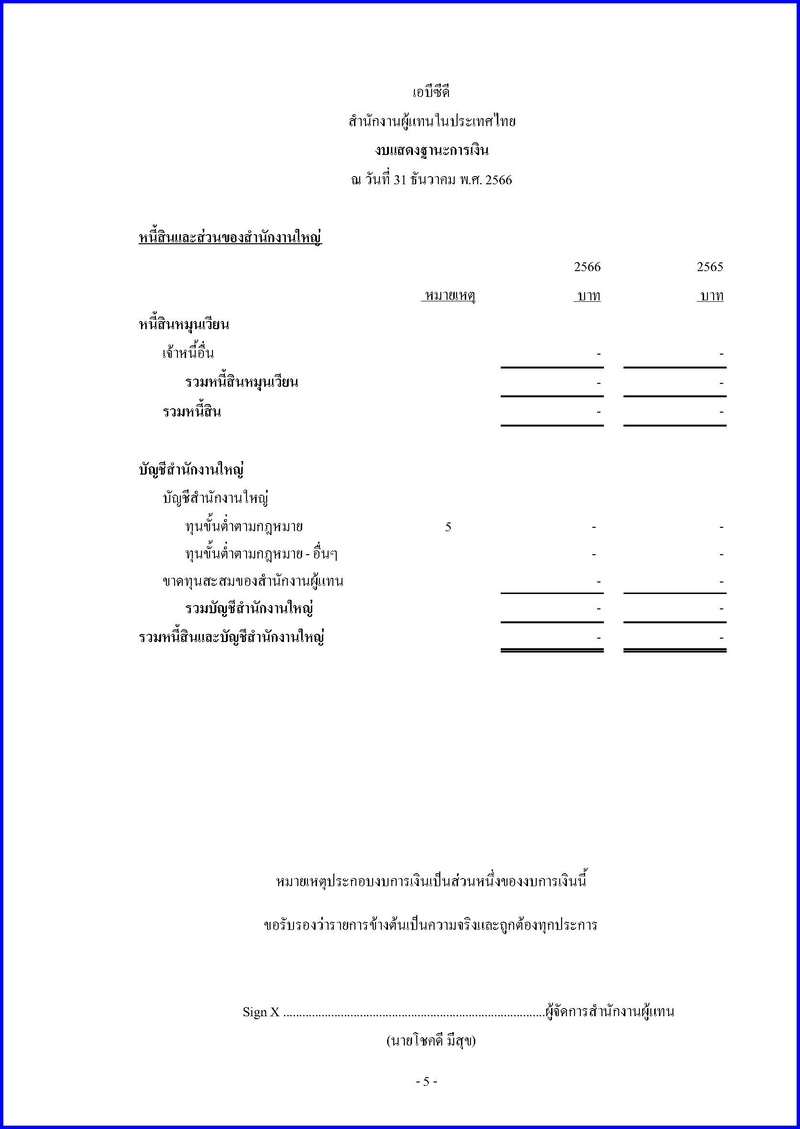

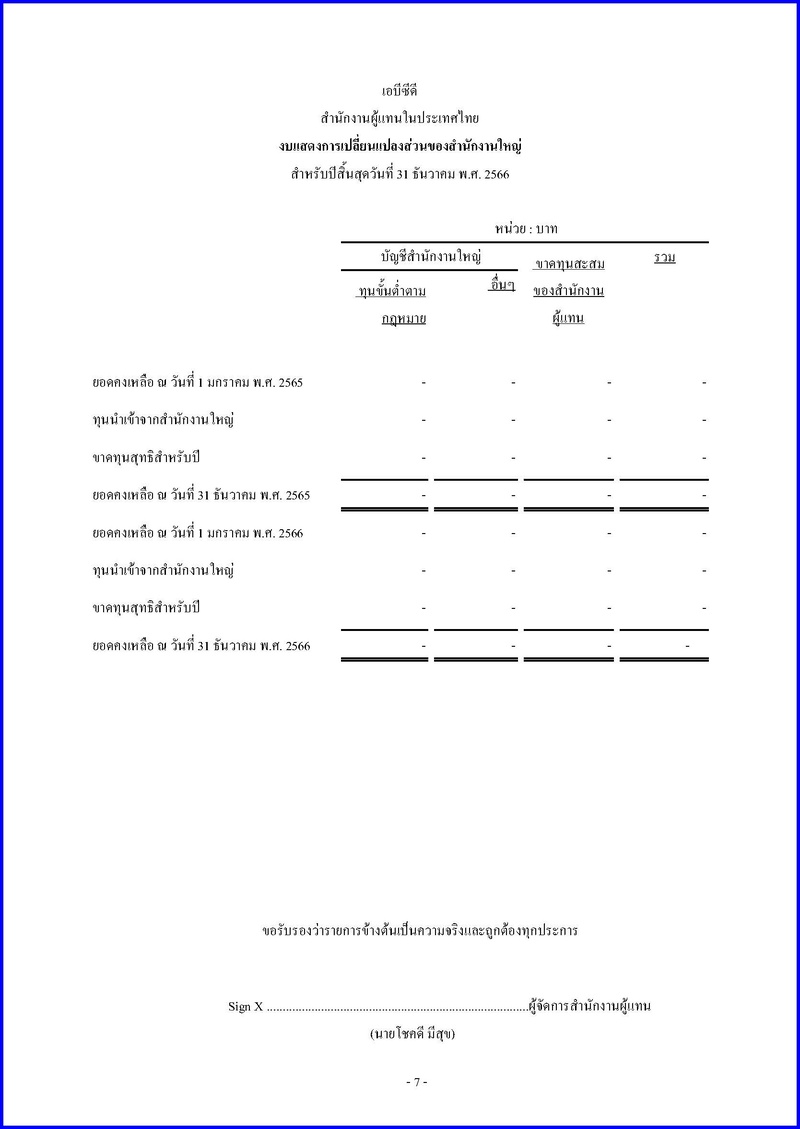

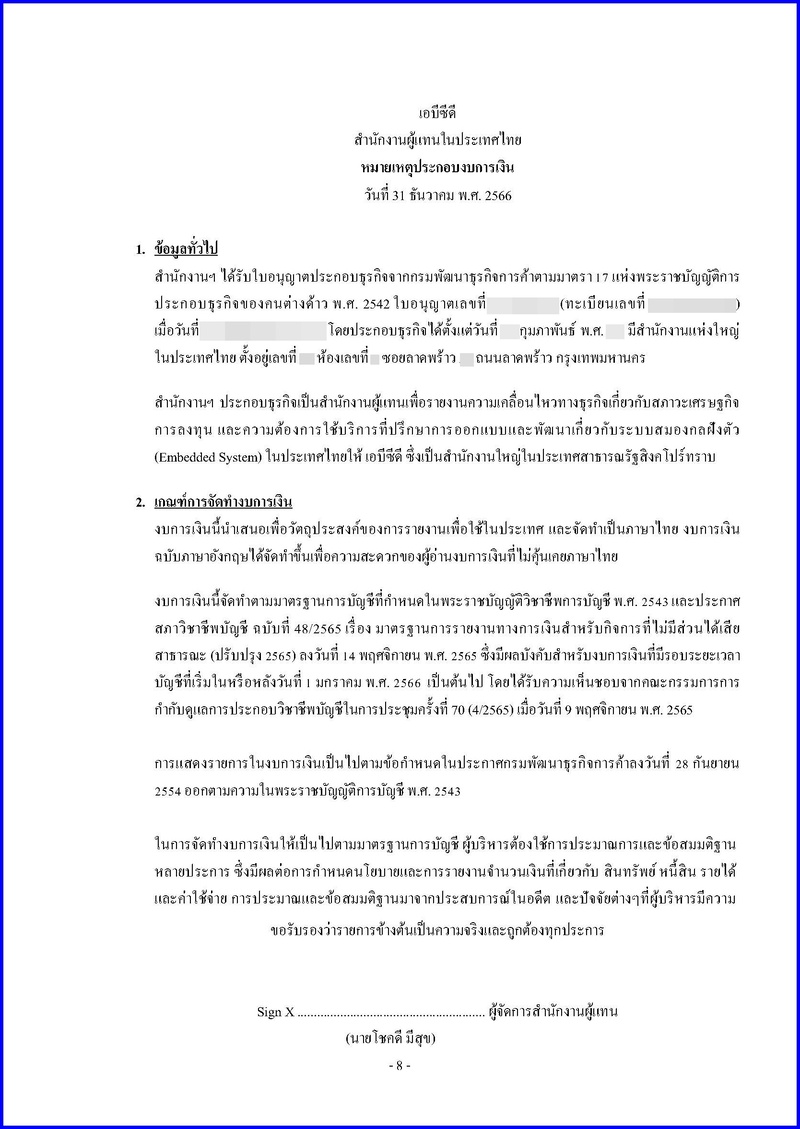

- The representative must prepare the accounting and submit the financial statements to the Department of Business Development

Incidentally, if the head office in overseas intends to do the accounting by self, our Panwa Accounting team is ready to support on assisting the information and collaborate with head office in overseas which Panwa Accounting will take care of taxes and accountant regarding to the law including the service of auditing, preparing the documents for submitting and submitting to the related agencies.

Regarding to 10 years’ experience over the service of representative office and team member of fluent communicable in English with understanding the system of setting up, remaining the tax structure, auditing until the closure or dissolution of the representative office, which you can trust on our professional team.

Accounting and Tax services

Panwa Accounting provides accounting service for representative offices which cover for the financial statements submitted to Thai Government departments (Revenue Department and Department of Business Development), also we can provide monthly financial statement, quarterly or yearly financial statements as required by head office and case of need to follow any audit requirement package (requested by Head Office’s Auditor).

With 15 years’ experience providing services to representative offices and you can trust our professional team who specializes in handling both Thai locals and foreigners to guide you thoroughly in understanding the whole system regarding setting up, tax structure, auditing and closing or dissolving representative offices

Financial statements (audited by certified public accountant) must be submitted to 2 departments as below:

- At Department of Business Development within 5 months from ending of accounting period.

- At Revenue Department within 150 days from ending of accounting period.

*Sample of Financial Statement will be shown at the bottom part of this webpage.

Tax Service and Tax structure for Representative Office in Thailand

Refer to Article 3 of Revenue Department announcement with regards to the income tax and trade tax for representative offices which are established under Foreign Business Law dated June 30, 1986, it states that any representative offices in Thailand are granted exemption not to report the income or the remuneration received from the head office, which it is to be calculated as income and pay corporate income tax in Thailand unless it falls under the following conditions:

- The head office pays remuneration for the expenses incurred when the representative office in Thailand provided various services to the head office.

- Representative office receives remuneration by only providing services to the head office, without serving to others.

However, if the representative office provides services to other parties regardless of remuneration that has been paid or not (refer to Article 4 of the above announcement), it is considered that the representative office is operating business in Thailand, and it has responsible to bring all kinds of income to combine and calculate the net profit in order to pay corporate income tax in Thailand.

Therefore, the tax structure for representative office must consist of only the remuneration paid by the head office, which is in accordance with the announcement of the Revenue Department (none of the income is subjected to the corporate income in Thailand).

| No. | Tax Form | Type of Tax | Filing Date |

| 1 | PND.1 | Withholding personal income tax return | Within 7 days of the following month |

| 2 | PND.1 Kor. | Withholding personal income tax return summarizing annually | Within 2 months of the end of calendar year |

| 3 | PND.3, PND.53 | Withholding corporate income tax return | Within 7 days of the following month |

| 4 | PND.54 | Withholding tax and profit remittance return | Within 7 days of the following month |

| 5 | PND.50 | Corporate Income Tax return (annually) | Within 150 days from ending period |

| 6 | PND.51 | Corporate Income Tax return (half year) | Within 2 months from mid of accounting period |

| 7 | PP.36 | Value Added Tax Remittance Return | Within 7 days of the following month |

In addition, if the head office in foreign country wishes to do accounting by themselves, Panwa Accounting team is ready to support with the information and cooperate with the Head Office in foreign country, which we will assist to manage the tax and serve as a bookkeeper according to the law, including providing services for auditing, preparing supporting documents for submission to the relevant departments.

Dissolution of Representative Office in Thailand (Closing) and return the license of representative office

Processing time is 3 working days

Things must know for dissolution of representative office in Thailand

- Register for dissolution (closing) at Ministry of Commerce

- Prepare and examine Financial Statement for closing period for dissolution of representative office.

- The manager of the representative office must inform for termination of business at Foreign Juristic Person Registration Department at Ministry of Commerce within 15 days from the date of closing of business

- The representative office, there is still duty to prepare financial statements as of the date of termination of business to submit to the Revenue Department within 150 days from the date of notifying the Foreign Juristic Person Registration Department.

Sample of Financial Statement

Q/A

Q1 – Does the representative office have to register for VAT?Panwa: In case a representative office is registered under Thai law, it is not required to register VAT due to the representative office does not operate business to generate income. Apart from performing duties as a representative of the head office within the scope of the business objectives registered with the Department of Business Development (according to the service business of representative provided on behalf of the foreign juristic which such business is engaged in international trade and does not have the obligation to pay VAT |

Q2 – My parent company in Germany is interested to set up the representative office in Thailand and I also have learned some details of the required documents already but I am wondering how I can specify the condition for the representative office manager on the power of attorney? Could you help to explain for this matter?Panwa: Please note that the details for appoint the representative office manager and the scope of authorization conditions will depend and can be decided by the parent company directly. Mostly they will specify to cover the authorization such as “to have the authorization for register the representative office in Thailand with the related Thai government, to manage the Thai representative office including can sign on any agreement, to prepare, sign and submit the related documents for the operation in Thailand with the private sector or government agencies both in the country and in overseas including can open and close the bank account and negotiate the operation etc.”. |

Q3 – I would like to inquire for register the representative office in Thailand which my parent company is in China. The affidavit/certificate was issued in Chinese language from the Chinese government but for the power of attorney to appoint the representative office manager, it was issued in English language. I would like to know if the affidavit that was issued in Chinese language can be used to submit for register the representative office or not? If in case cannot be used, then please advise what can I do?Panwa: Please note that the affidavit/certificate and the power of attorney to appoint the representative office manager need to use both in English and Thai versions certified by translator. If in case the parent company issued the documents in Chinese language, need to translate to English first then to Thai language. Moreover, the documents that need to submit to register are:

|

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th

WhatsApp: +66 85 713 1000

LineApp ID: @panwa

Address: 1560 Latphrao Rd., Wangthonglang, Bangkok 10310, Thailand.

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Sky train: Yellow Line, Chokchai 4 Station, Gate 4. Our office is located between Soi Latphrao 50 and 52.