Representative Office in Thailand

We provide all kinds of services related to operations of Representative Offices in Thailand which are;

- Register or Set up Rep office in Thailand

- Accounting service

- Tax service

- Auditing service

- Liquidation – Closing of representative office

Service Fee for Accounting and Tax (item 1&2) is Baht 5,000 per month.

Representative Office (Rep Office) Thailand – Setting up and Registration

Representative Office (Rep Office) in Thailand is a good way for foreign businesses to explore business opportunities in Thailand.

Serivce fee is Baht 50,000.

Timeline: 1o days

Scope of business of a representative office

1. Procurement of supply sources for goods and services in Thailand for the head office.

2. Inspection and control of the quality and volume of goods purchased by the head office or hired by the head office for production in Thailand.

3. Consultation on various aspects pertaining to the goods distributing by the head office to the district agent or consumer of goods.

4. Dissemination of various information pertaining to new goods or services offered by the head office.

5. Reporting business movements in Thailand to the head office.

General Criteria:

1. The office must be a juristic person established under the laws of a foreign country.

2. The office must not derive any revenue from its offices.

3. The office cannot accept purchase orders, make sales offers or engage in business negotiations with any person.

4. The office must receive subsidies for office expenses from the head office only.

5. The office must prepare financial statements from the Accounting Act.

Conditions:

1. Loans from banks or other financial institutions which are incidental to a licensee’s business operations, where the representative office registered in Thailand can be made to an amount not exceeding the proportion of one part capital to seven parts loan.

2. The appointed of representative office in Thailand can be the foreigner(s) or Thai nationality and individual only.

Accounting Service for Representative Office in Thailand, Bangkok and provinces

Panwa Accounting provides accounting service for representative offices which covers the financial statements submitted to Thai Government departments (Revenue Department and Department of Business Development), also we can provide (based on requested) monthly financial statement (report), quarterly or specific financial statements as required by you (or your head office) and case of need to follow any audit requirement package (requested by Head Office’s Auditor).

With almost 20 years of experience providing services to representative offices, you can trust our professional team who specializes in handling both Thai locals and foreigners to guide you thoroughly in understanding the whole system regarding setting up, tax structure, auditing and closing or dissolving representative offices.

Financial statements (audited by certified public accountant) must be submitted to 2 departments as below:

- At Department of Business Development within 5 months from ending of accounting period.

- At Revenue Department within 150 days from ending of accounting period.

*Sample of Financial Statement be presented as bottom part of this webpage.

**Sample of Monthly report (Balance Sheet, Income Statement and its detail) be represented as bottom part of this webpage.

Tax Service for Representative Office in Thailand, Bangkok and provinces

Refer to Article 3 of Revenue Department announcement with regards to the income tax and trade tax for representative offices which are established under Foreign Business Law dated June 30, 1986, it states that any representative offices in Thailand are granted exemption not to report the income or the remuneration received from the head office, which it is to be calculated as income and pay corporate income tax in Thailand unless it falls under the following conditions:

1. The head office pays remuneration for the expenses incurred when the representative office in Thailand provided various services to the head office.

2. Representative office receives remuneration by only providing services to the head office, without serving to others.

However, if the representative office provides services to other parties regardless of remuneration that has been paid or not (refer to Article 4 of the above announcement), it is considered that the representative office is operating business in Thailand, and it is responsible to bring all kinds of income together and calculate the net profit in order to pay corporate income tax in Thailand.

Therefore, the tax structure for representative office must consist of only the remuneration paid by the head office, which is in accordance with the announcement of the Revenue Department (none of the income is subjected to the corporate income in Thailand).

| Ref | Tax Form | Type of Tax | Deadline of submission |

| 1 | PND.1 | Withholding personal income tax returns | Within 7 days of the following month |

| 2 | PND.1 Kor | Withholding personal income tax returns summarizing annually | Within 2 months of the end of calendar year |

| 3 | PND.3, PND.53 | Withholding corporate income tax returns | Within 7 days of the following month |

| 4 | PND.54 | Withholding tax and profit remittance returns | Within 7 days of the following month |

| 5 | PND.50 | Corporate Income Tax returns (annually) | Within 150 days from ending period. |

| 6 | PND.51 | Corporate Income Tax returns (half year) | Within 2 months from mid of accounting period |

| 7 | PP.36 | Value Added Tax Remittance Returns | Within 7 days of the following month |

In addition, if the head office in foreign country wishes to do accounting by themselves, we, Panwa Accounting team is ready to support with the information and cooperate with the Head Office in foreign country, which we will assist to manage the tax and serve as a bookkeeper according to the law, including providing services for auditing, preparing supporting documents for submission to the relevant departments.

With almost 20 years of experience providing services to representative offices, you can trust our professional team who specializes in handling both Thai locals and foreigners to guide you thoroughly in understanding the whole system regarding setting up, tax structure, auditing and closing or dissolving representative offices.

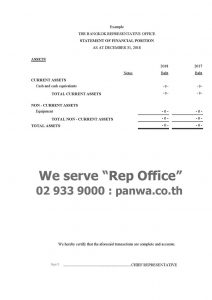

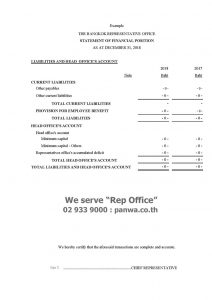

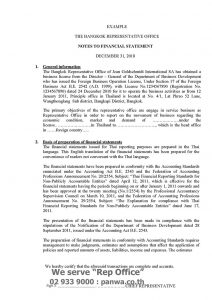

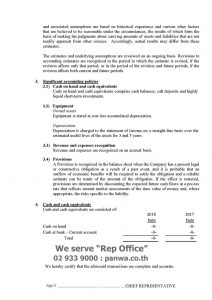

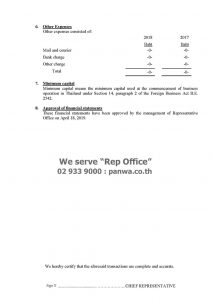

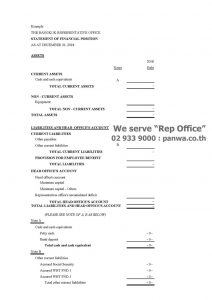

Financial Statement of Representative Office in Thailand – Sample

The yearly financial statement must be submitted to Revenue Department within 150 days and be submitted to Department of Business Development within 5 months even though the Rep Office don’t have transaction.

Monthly Report (the format can be jointly set up)

In case needed, we can provide monthly report (Balance Sheet, Income Statement, etc.), which the format and deadline can be set follow the requirements of the clients, as long as both parties (Panwa team and client side) are in favor with the conditions.

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: chonthira@panwa.co.th (Ms.Chonthira, Director)

WhatsApp: +66 85 713 1000

LineApp ID: @panwa

Address: 1560 Latphrao Rd., Wangthonglang, Bangkok 10310, Thailand.

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Sky train: Yellow Line, Chokchai 4 Station, Gate 4. Our office is located between Soi Latphrao 50 and 52.

Greetings,

We develop systems to serve more customers with reasonable fees.

Mr. Tana Sipa,

CPA Thailand and Director

WhatsApp: +66 81 919 6225

Email: bkk@panwa.co.th

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Hi,

I would like to request for quotation of monthly service charges of:

1. Preparation of monthly payroll

2. Payment of expenses/payables including payroll payables (tax and social insurances)

3. Bookkeeping of transaction of Rep office

4. Preparation of financial statement by year end

5. All statutory compliance, government requirements for Rep office.

Could you please advise your best rate?

Thank you very much for your interesting in our services for Representative Office in Thailand, our Manager will contact via email for the detail within today.