Filing the Disclosure Form to the Revenue Department – Thailand

Disclosure Form is the annual report form for the company or juristic partnership that are related with each other, according to the Revenue Code section 71 Bis who have the total income not less than Baht 200 million in the accounting period. This form should be electronically submitted within 158 days through the Revenue Department website.

In case of delay submission, the penalty fee are as below:

- If delay within 7 days after deadline, the penalty is Baht 50,000

- If delay over than 7 days after deadline, the penalty is Baht 100,000

- If determined by officer, the penalty is Baht 200,000

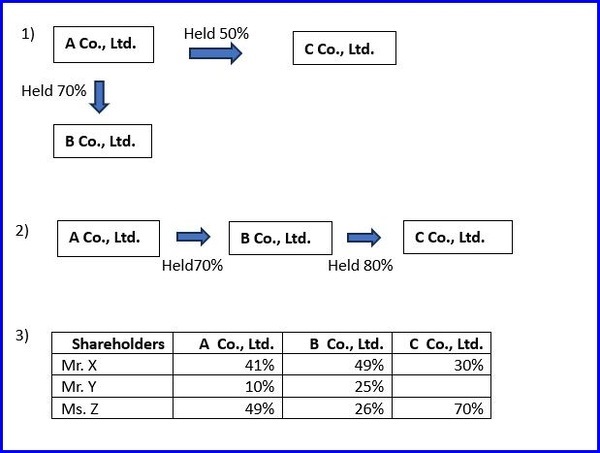

The sample of the shares holding for related entities (Revenue Code section 71 Bis) as following:

- A Co., Ltd., B Co., Ltd., and C Co., Ltd., are the related companies according to the above structure due to A Co., Ltd., held the shares on B and C Co., Ltd., not less than 50%.

- A Co., Ltd., B Co., Ltd., and C Co., Ltd., are the related companies which A Co., Ltd., held the shares of B Co., Ltd., not less than 50% and held the indirect shares of C Co., Ltd., through B Co., Ltd., 56%.

- A, B and C Co., Ltd., are the related companies that they held the shares not less than 50% through the group of shareholders.

Remark: the shares holding entities structure which are related companies (Revenue Code section 71bis) even there are changed its structure during the year that effect to the shares holding less than 50% but it is still considered as the related companies for such year.

Question and Answer

|

Q1 – The consideration criteria related companies as of Revenue Code section 71 Bis space 2 states that “the shareholders who hold the shares in entities not less than 50% of all shares and the shares holding in other entities even the direct or indirect not less than 50% of all shares”. For the “shareholders” specified above, does it mean any individual or group of combined several shareholders which hold overlapping shares? Panwa – The related companies according to the Revenue Code section 71 Bis space 2 covers the individual shareholders and the combined several shareholders. |

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th

WhatsApp: +66 85 713 1000

LineApp ID: @panwa

Address: 1560 Latphrao Rd., Wangthonglang, Bangkok 10310, Thailand.

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Sky train: Yellow Line, Chokchai 4 Station, Gate 4. Our office is located between Soi Latphrao 50 and 52.