Filing tax return – Personal Income Tax (PND. 90, 91)

Foreign resident in Thailand, according to “Resident Rule” or anyone who has generated income in Thailand according to the “Source Rule” must file a Personal Income Tax Return in Thailand.

How to file Tax Return?

1. By hand (paper) – Dateline on March 31.

2. By E-Filing – Dateline on April 8.

The required documents are as following;

- Copy of passport

- Copy of Tax ID Number (TIN Card)

- Taxpayer’s deduction and allowance information, you can fill up via this L.Y.01 Form (Download).

Service fee; start Baht 12,000.-

( In case of many kinds of income and its information, the fee will start at Baht 24,000 )

– Apply for E-Filing is free of charge

– Be a representative to meet and clarify to the Tax Authority for free 1 time

Other Information:

Who has the responsibility to file PND. 90?

A taxpayer who has assessable income according to section 40 (1) to (8) of the Revenue Code and has many types of income (but not the income under section 40 (1) of the Revenue Code one type) in the tax year 2023 must follow the rules as:

- Single taxpayer who has a total of assessable income exceeding 60,000 Baht in the tax year.

- Spouse who has a total of assessable income whether on one side only or combined with your spouse exceeding 120,000 Baht in the tax year.

- Undivided estate has assessable income exceeding 60,000 Baht

- Non-registered ordinary partnership has assessable income exceeding 60,000 Baht

- Group of persons that has assessable income exceeding 60,000 Baht

- Community Enterprise, according to the law under Community Enterprise Promotion, only for limited partnership or group of persons with the total income exceeding 1,800,000 Baht in the tax year, or with the total income exceeding 60,000 Baht in the tax year, but not more than 1,800,000 Baht with an exemption from income tax under rules and conditions as prescribed by the Director-General.

Related Topics:

- Tax planning for foreigner resident in Thailand – Click here

- Apply Tax Residence Certificate – Click here

- Apply Tax ID Number (TIN) – Click here

- Other Services – Click here

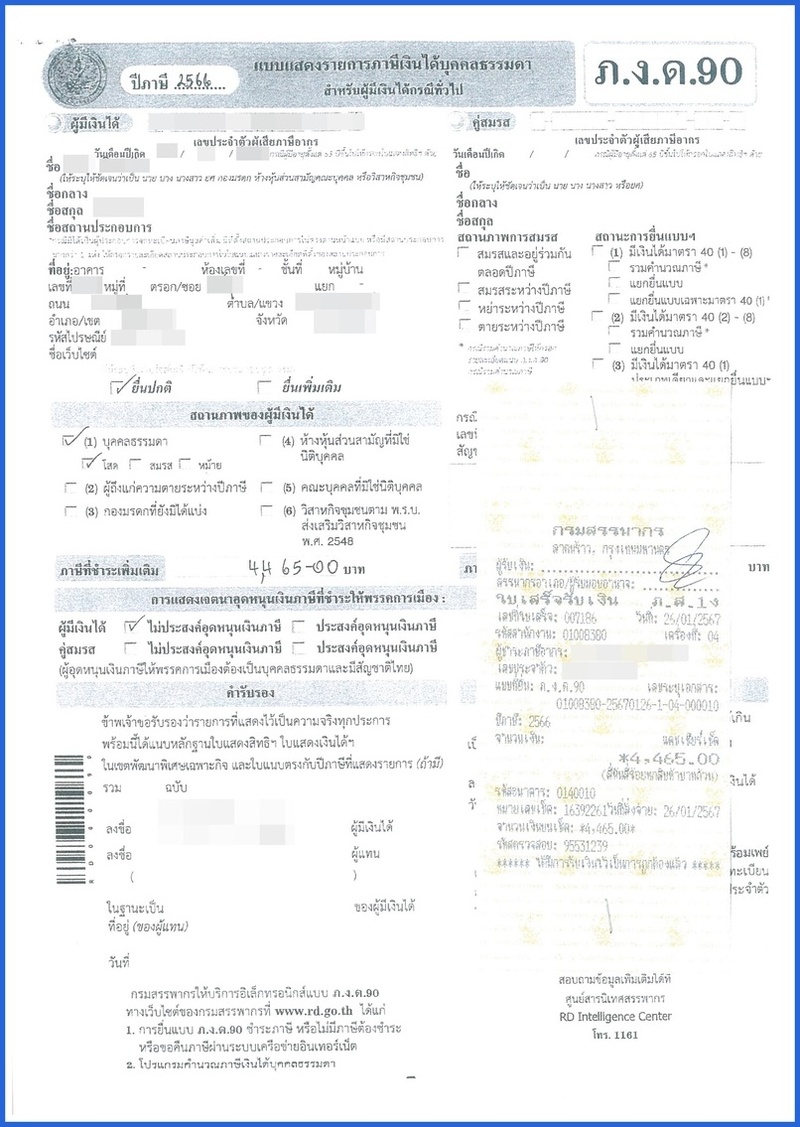

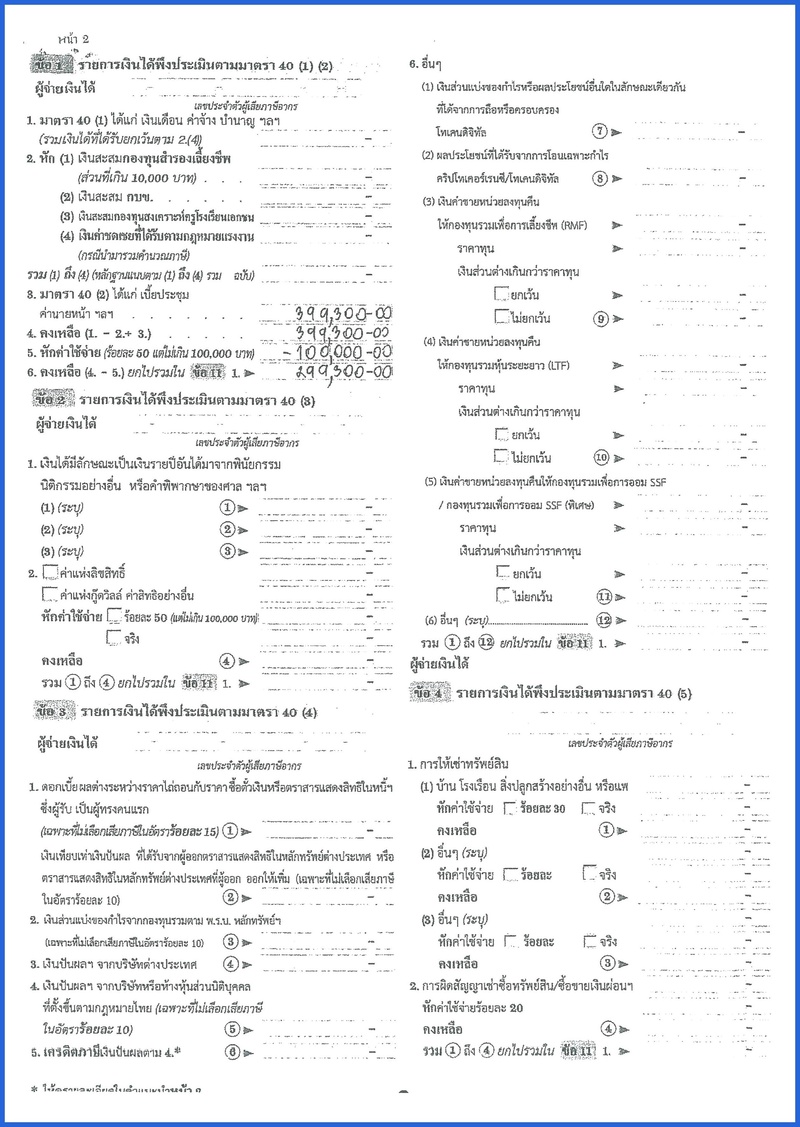

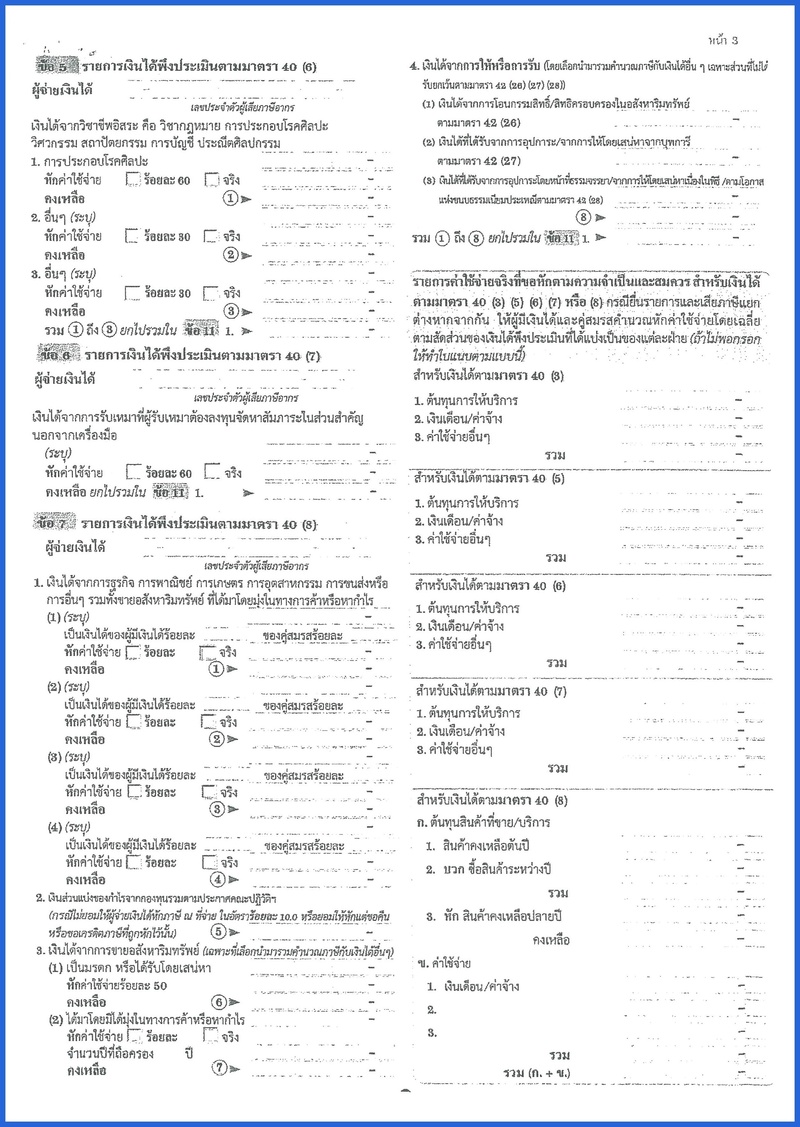

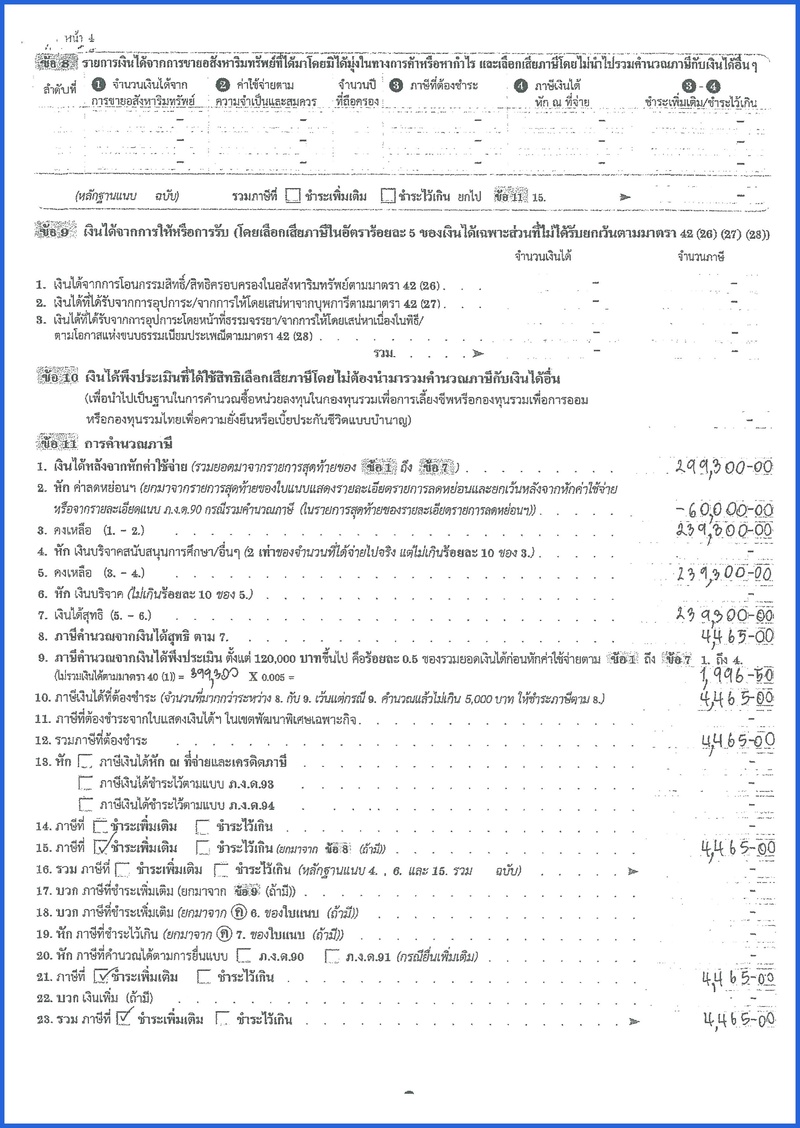

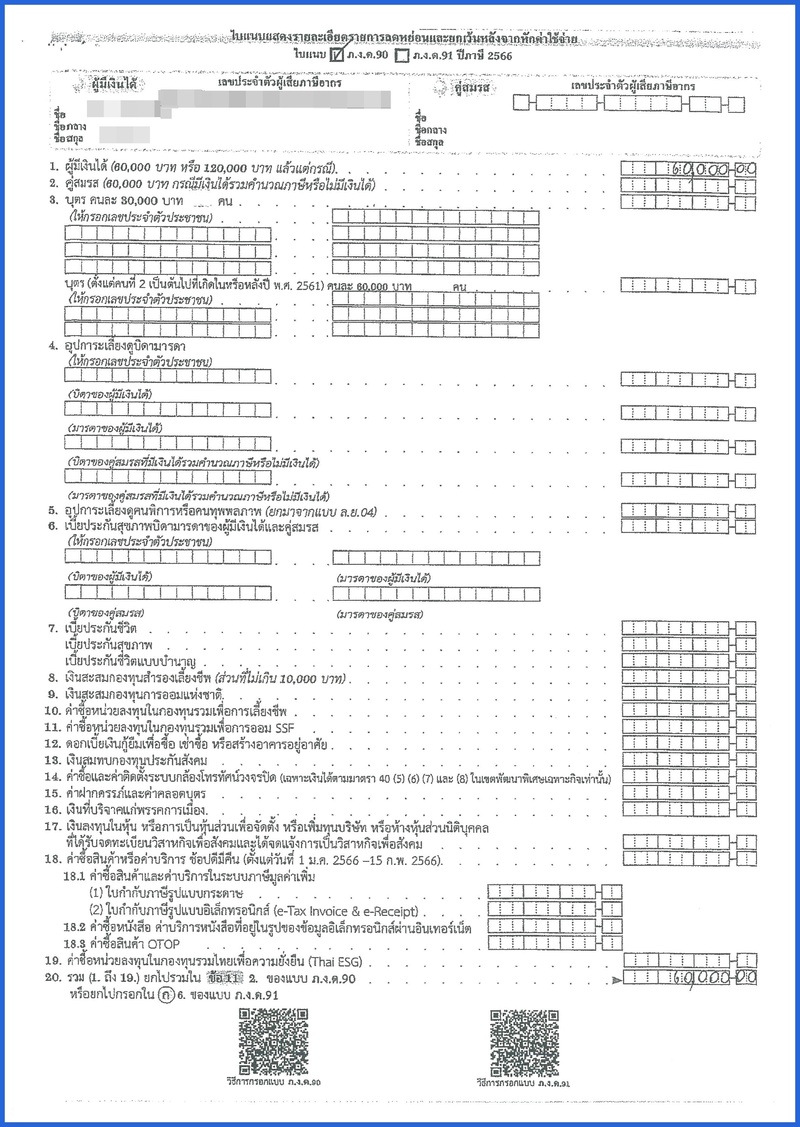

Sample of Tax Return Form (PND. 90)

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th

WhatsApp: +66 85 713 1000

LineApp ID: @panwa

Address: 1560 Latphrao Rd., Wangthonglang, Bangkok 10310, Thailand.

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Sky train: Yellow Line, Chokchai 4 Station, Gate 4. Our office is located between Soi Latphrao 50 and 52.